Mathematics us the only exact science, all power under heaven and on earth us given into the man who masters the simple science of mathematics, emerson said: “God does indeed geometrize. “ another wise man said : “there is nothing in the universe but mathematical point .” pythagiras one of the greatest mathematicians that ever lived, ofter exoerimenting with numbers and finding the proofs of all naturals laws, said: “before god was numbers.” He believed that the vibration of numbers created god and the diety. It has been said,”figures don’t lie.” Men have been convinced that numbers tell the truth and that all problems can solved by them. The chemist, engineer, astronomer would be lost without the science of mathematics.

It is so simple and easy to solve problems and get correct answers and result with figures that it seems strange so few people rely on them to forecast the future of business, stocks and commodity markets. The basic principles are easy to learn and understand. No matter whether you use geometry, trigonometry, or calculus, you use the simple rules of arithmetic. You do only two things : you increase or decrease.

There are two kinds of numbers, odd and even. We add numbers together, which is increasing . we multiply , which is a shorter way to increase. We subtract, which decreases, and we divide, which also decreases with the use of higher mathematics, we find a quicker and easier way to divide subtract add and multiply yet very simple when you understand it.

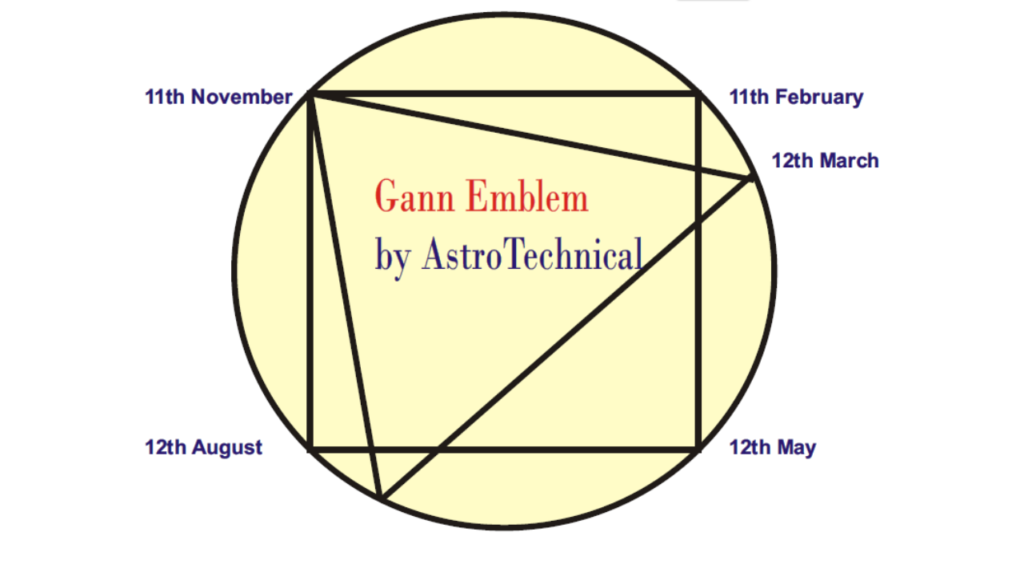

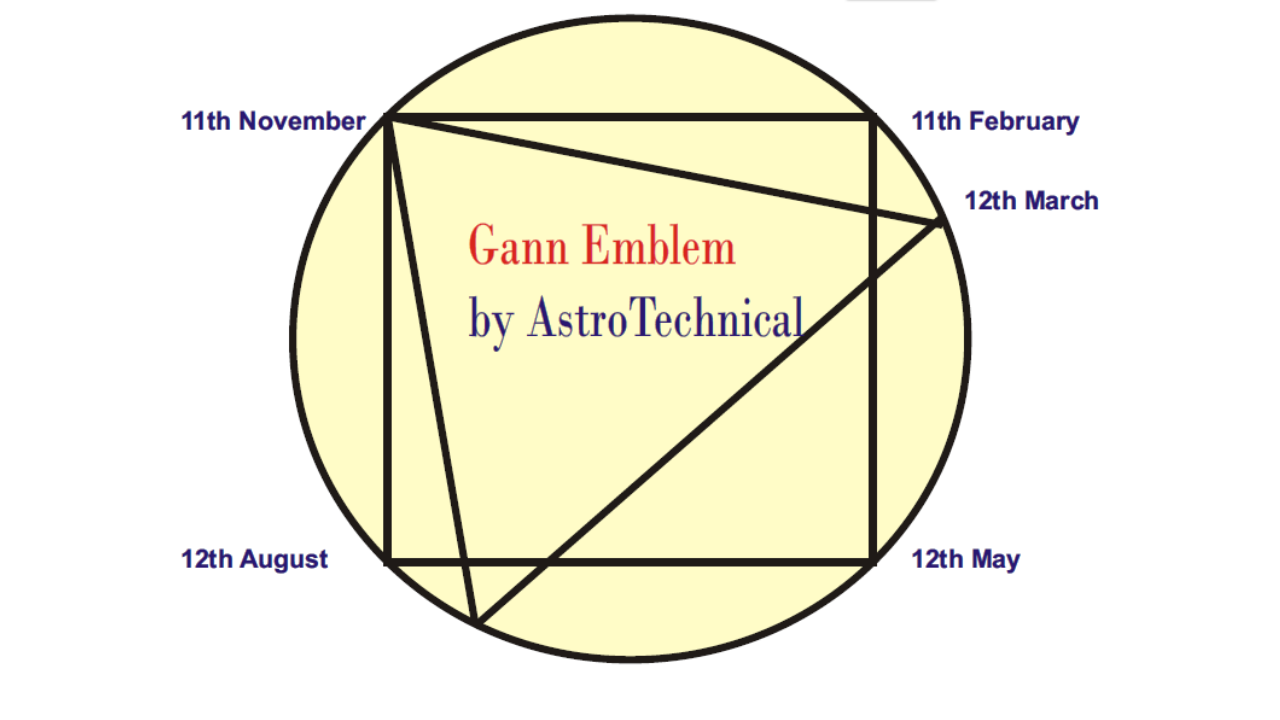

Everything in nature is male and female, white and black, harmony or inharmony, right and left. The market moves only two ways, up and down. There are three dimensions which we know how to prove- width, length and height. We use three figures in geometry- the circle, the square, and the triangle. We get the square and triangle points of a circle to determine points of time, price and space resistance. We use the circle of 360 degrees to measure time and price.

There are three kinds of angles the vertical, the horizontal, and the diagonal, which we use for measuring time and price movements. We use the square of odd and even numbers to get not only the proof of market movements, but the cause.

How to Make CHARTS

Charts are records of past market movements. The future is but a repetition of the past. There is nothing new. As the bible says- “ the thing that has been , it is that which shall do.”

History repeats and with charts and rules we determine when and how it is going to repeat. Therefore the first and most important point to learn is how to make charts correctly because if you make an error in the chart you will make an error in applying the rules to your trading.

Daily Chart: When you are trading in a stock that is active you should always keep up a daily high and low chart but for study purposes it is enough to keep up the weekly and monthly charts. The daily chart shows the minor trend and shows a change in trend much oftener than only of the ither charts, but the indication does not last as long or run so far. This chart should be kept up the same as the others, except when stocks are selling below 50 or when they are in an inactive trading range then the spacing should be ½-point to each 1/8-inch on the chart paper, allowing two spaces to represent on full point or $1 per

Geometrical Angles / gann Angle

After long year of practical experience i have discovered that geometrical angle mesure accurately space, time, volume and price.

Mathematics is the only exact science as i have said before. Every nation on the face of the earth agrees that 2 and 2 make 4, no matter what language it speaks, yet all other sciences are not in accord as mathematical science. We find different man in different professions along scientific lines disagreeing on problems, but there can there can be no disagreement in mathematicak calculations.

There are 360 degrees in a circle no matter how large or how small the circle may be. Cortain number of these degree and angles are of vast importance and indicate when important tops and bottom occur on stocks

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.